Investors Announce Nearly $75 Million in Funding for Community Solar

Investors are continuing to pour money into community solar projects, with groups on July 31 announcing nearly $75 million in funding for multiple installations.

Renewable Properties, which develops and invests in small-scale utility and community solar installations, on July 31 said it has closed its Fund 9 portfolio. The company said the $53.5 million portfolio expands Renewable Properties relationships with SOLCAP, a tax equity investor, and lending partners 1st Source Bank and West Town Bank & Trust.

That funding announcement comes on the same day that Babcock & Wilcox (B&W) Enterprises said its subsidiary, Babcock & Wilcox Solar Energy, has been awarded contracts totaling more than $20 million by Summit Ridge Energy (SRE) for the engineering, procurement and construction (EPC) of six community solar energy projects in Illinois with a total of 25 MW of generation capacity.

Funding for Projects in Several States

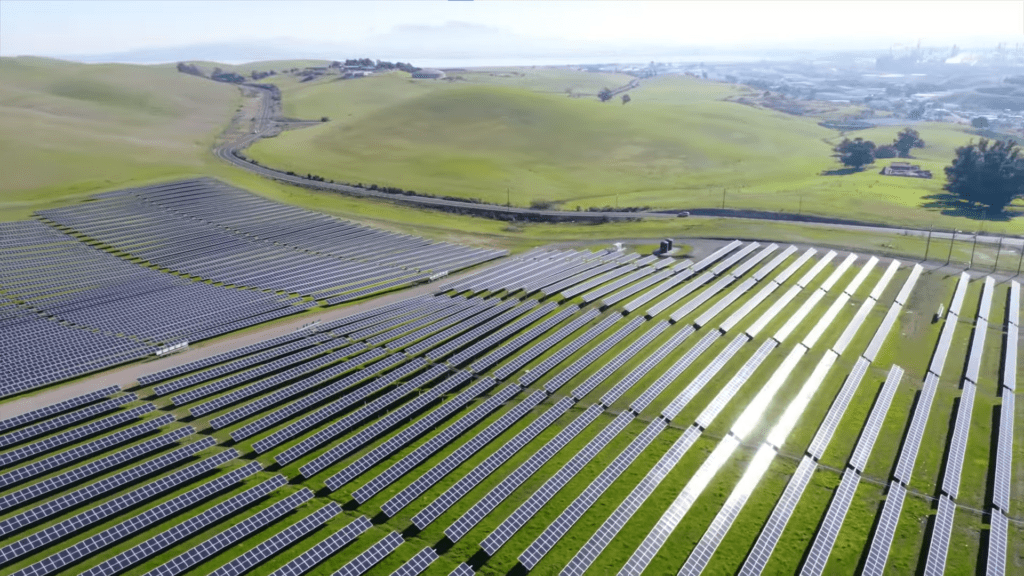

Renewable Properties said the Fund 9 portfolio includes five projects in Maine, North Carolina, and California, with combined generation capacity of 22 MW.

“Dependable financing relationships are key for expanding Renewable Properties’ pipeline of community solar and small-scale utility projects,” said Allan Riska, chief investment officer at Renewable Properties. “Our ongoing partnerships with SOLCAP, 1st Source, and West Town are enabling us to bring solar’s clean energy benefits to America’s rural areas. We look forward to continuing to work with them to deploy community solar projects across the U.S.”

B&W in its announcement Monday said it has executed multiple projects for SRE. That includes a $15 million project announced in March of this year—that one for five installations in Illinois—and a $20 million project announced in August 2022. That funding supported construction of seven projects led by SRE, also in Illinois.

Renewable Properties said it has used SOLCAP as a tax equity resource since 2021. SOLCAP, a joint venture of KeyState Renewables and Corner Power, has invested in three tax equity funds—including Fund 9—that have supported construction and acquisition of 65.3 MW of Renewable Properties’ community solar and small-scale utility projects in five states.

“We are pleased to continue and grow our tax equity collaboration with Renewable Properties,” said Josh Miller, CEO of KeyState Renewables, the managing member of SOLCAP. “Their focus on community solar and small-scale utility solar projects supports our shared vision for expanding access to local clean energy throughout the U.S.”

Construction and Permanent Loans

Renewable Properties’ Fund 9 is the second portfolio supported by 1st Source, which has provided construction and permanent loans for 21.6 MW of Renewable Properties’ solar projects in the past year. The closing of Fund 9 supports Renewable Properties’ acquisition of three community solar projects in Maine with a total of 11.6 MW of generation capacity. Those three installations are under construction and expected to come online in the first quarter of 2024.

“We are pleased to be working again with Renewable Properties, an exceptional partner in our shared dedication to community solar,” said Russell Cramer, who leads 1st Source Bank’s financing division. “We’re excited to continue working with their team to bring more clean energy to communities throughout the United States.”

West Town since 2019 has participated in three Renewable Properties’ portfolio financings, including Fund 9. The group has provided construction and permanent loans for 38.5 MW of projects.

“West Town is pleased to be joining Renewable Properties for our third fund,” said Riddick Skinner, executive vice president (EVP) of Government Lending for West Town Bank & Trust. “Our bank is known for creating long-lasting relationships, and Renewable Properties is the perfect example. We’re excited to continue supporting the deployment of solar projects that create clean power and good-paying jobs in local communities.”

West Town’s investment in Fund 9 will support a 6.62-MW solar project in Gibson, North Carolina, which is scheduled for completion by year-end. West Town also is partnering on a 4.2-MW community solar project in El Nido, California, which is set for completion in May of next year.

Six Projects in Illinois

B&W on Monday said it will engineer, procure, and build the six Illinois solar projects for SRE, with completion expected next year.

“We value our strong, ongoing relationship with Summit Ridge Energy and are excited to develop more projects in the future as we look to grow and expand B&W’s presence in the community solar industry,” said Jimmy Morgan, EVP and chief operating officer for B&W. “We appreciate the confidence Summit Ridge Energy has shown in B&W’s installation, site coordination and project management expertise and look forward to continuing to work together.”

“As Summit Ridge Energy continues to expand our solar leadership in Illinois, we’re pleased to partner with B&W on another EPC contract,” said Raj Soi, EVP of Operations for SRE. “We are proud of our work to create new jobs in Illinois, invest in the local economy and provide solar power savings to more than 20,000 households and businesses.”

B&W said the company has installed more than 100 solar power projects.

SRE is the largest commercial solar developer and owner-operator in Illinois, with an energy portfolio of about 250 MW across the state. The company said it has invested more than $900 million in Illinois through the development and acquisition of 116 individual solar farms, located across 35 counties.

—Darrell Proctor is a senior associate editor for POWER (@POWERmagazine).